How to get lic existence certificate

Click to download the life existence certificate / jeevan praman patra in pdf free download. The form is available in both English and Hindi. Free download format. Lic existence certificate download.

For annuity plans with LIC, the existence certificate serves a similar purpose as for other life insurance policies. It verifies that the annuitant (the person receiving the annuity payments) is alive and that the annuity plan is still in force. Annuity plans provide periodic payments to the annuitant, usually in exchange for a lump sum payment or periodic premium payments made to the insurer.

The existence certificate may be required by the annuitant to continue receiving annuity payments or for other administrative purposes. It typically contains information such as the annuitant’s name, annuity policy number, and confirmation of the policy’s active status.

What is LIC Certificate of Existence

In LIC (Life Insurance Corporation of India), an existence certificate is a document that is used to confirm the survival of the policyholder. It is an important document that needs to be submitted by the policyholder or the nominee of the policy to the insurance company at regular intervals to ensure that the policy benefits are paid on time.

The existence certificate serves as proof that the policyholder is alive and confirms that the policy benefits should continue to be paid to the policyholder or nominee. It is typically required to be submitted annually or at regular intervals, as specified in the policy terms and conditions.

The existence certificate can be obtained from a government authority, such as a gazetted officer or a magistrate, or from a medical practitioner. The certificate needs to be duly filled and signed by the authority along with the policyholder’s signature and thumb impression.

How to fill a life/existence certificate

You can fill the Lic existence certificate online

The specific information required to be filled out on an LIC existence certificate for annuity plans may vary depending on the requirements of LIC and the purpose for which the certificate is being requested. However, typically, the following information may be required:

- Annuitant’s Name: The full name of the annuitant who is receiving the annuity payments.

- Policy Number: The unique policy number assigned to the annuity plan.

- Date of Birth: The annuitant’s date of birth may also be required for verification purposes.

- Date of Issuance: The date when the existence certificate is issued.

- Signature: The annuitant may be required to sign the existence certificate to certify its accuracy.

- As for getting the existence certificate attested, it depends on the specific requirements of the institution or organization requesting the certificate. Some organizations may require the existence certificate to be attested by a gazetted officer or a notary public to verify its authenticity. It’s essential to check the specific requirements of the organization requesting the certificate and follow their instructions accordingly. If attestation is required, it’s typically done after filling out the necessary information on the certificate form and before submitting it to the concerned authority.

It’s important to note that failing to submit the existence certificate can result in the suspension or termination of the policy benefits. Therefore, it’s advisable to ensure timely submission of the existence certificate to avoid any inconvenience or loss.

Which policies need existence certificate?

All types of pension policies offered by LIC (Life Insurance Corporation of India) require the submission of a life certificate by the policyholder to confirm their survival. These include:

- Jeevan Akshay plans

- New Jeevan Nidhi plans

- Jeevan Shanti plans

- Pradhan Mantri Vaya Vandana Yojana (PMVVY)

- Varishtha Pension Bima Yojana (VPBY)

In these policies, the policyholder receives periodic pension payments or annuity payments from the insurance company, and the life certificate ensures that the payments are made only to the policyholder and not to any other person. The frequency of submission of the life certificate may vary based on the policy terms and conditions, but it is usually required on an annual basis.

LIC Existence certificate online

Yes, LIC often provides online facilities for policyholders to submit life existence certificates conveniently. LIC’s online portal or mobile app may offer a feature for policyholders to upload their life existence certificates digitally. This can save time and effort compared to submitting physical documents through mail or in person.

To submit the life existence certificate online, you may need to log in to your LIC account on their official website or mobile app. From there, you can navigate to the relevant section for submitting documents or managing your policy. Follow the instructions provided to upload the life existence certificate as required.

If you’re unsure about how to submit the life existence certificate online or if you encounter any issues, you can contact LIC’s customer service for assistance. They can guide you through the process and provide support as needed.

It’s advisable to check the policy document or contact the LIC customer service for more information on the specific requirements related to the submission of the life certificate for a particular pension plan.

Why LIC Existence certificate is required

An existence certificate, often required by institutions like insurance companies, pension funds, banks, or government agencies, serves several important purposes:

- Verification of Continuity: An existence certificate verifies that the person named in the certificate is alive and exists. This is crucial for institutions managing financial transactions, insurance policies, pensions, or other benefits to ensure they are disbursing funds to legitimate recipients.

- Prevention of Fraud: Requiring an existence certificate helps prevent fraud, such as unauthorized access to funds or benefits after the death of the intended recipient. It provides a mechanism for confirming the continued eligibility of individuals to receive payments or benefits.

- Compliance: Many financial regulations and institutional policies mandate periodic verification of the existence of individuals receiving funds or benefits. Requiring an existence certificate helps institutions remain compliant with these regulations and internal policies.

- Risk Management: Verification of the existence of individuals receiving funds or benefits helps mitigate the risk of erroneous payments, identity theft, or other forms of financial misconduct.

Legal Requirement: In some cases, providing an existence certificate may be a legal requirement stipulated by government regulations or contractual agreements between parties involved in financial transactions or benefit disbursements.

The life existence form is also known by several other names, including:

- LIC Survival certificate

- LIC Existence certificate

- LIC Proof of life certificate

- LIC Pension certificate

- LIC Certificate of existence

- LIC Jeevan Praman

These terms are used interchangeably to refer to the same document that confirms the policyholder’s survival and is required for the continuation of certain types of policies, particularly pension plans. The life certificate serves as a crucial document to ensure that the policy benefits are paid out only to the policyholder and not to any other person in their absence.

Can I submit life certificate online?

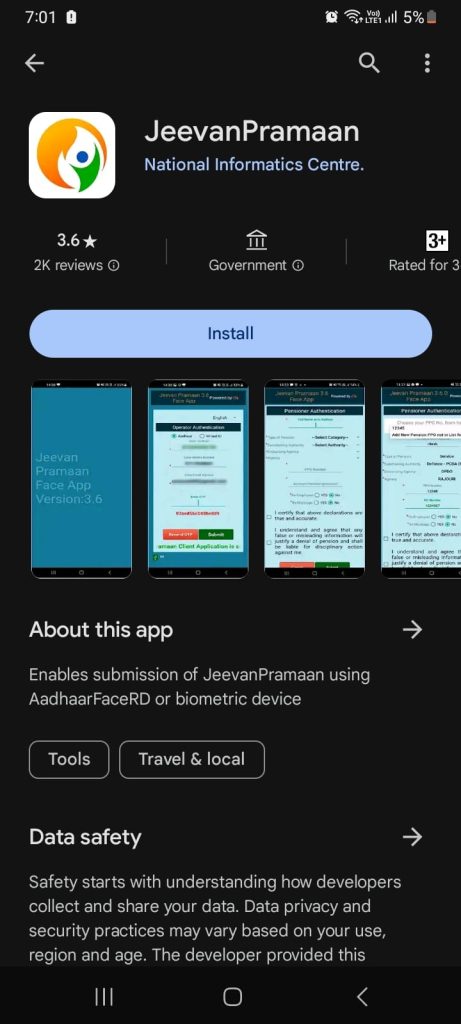

Yes, LIC (Life Insurance Corporation of India) has introduced the facility of submitting the life certificate online for the policyholders’ convenience. Policyholders can submit the life certificate online through the LIC’s official website or mobile app. The online submission of the life certificate is known as the “Jeevan Pramaan” service, which is an Aadhaar-based digital life certificate.

To submit the life certificate online through Jeevan Pramaan, the policyholder needs to have an Aadhaar number and a registered mobile number linked to the Aadhaar card. The policyholder can download and install the Jeevan Pramaan mobile app or visit the LIC website and navigate to the Jeevan Pramaan portal to initiate the online submission process. The policyholder needs to follow the instructions and complete the authentication process using their Aadhaar details to generate the digital life certificate.

The digital life certificate generated through Jeevan Pramaan is valid for one year from the date of submission and can be used for the renewal of pension policies and other similar purposes. The online submission of the life certificate through Jeevan Pramaan is a convenient and hassle-free option for policyholders who may find it difficult to submit the certificate physically or in person.

The Jeevan Pramaan app can be downloaded from the Google Play Store for Android users and from the App Store for iOS users. Here are the links to download the app:

For Android: https://play.google.com/store/apps/details?id=jp.nic.JeevanPramaan

For iOS: https://apps.apple.com/in/app/jeevan-pramaan/id1170494433

It is important to note that the Jeevan Pramaan app requires the policyholder to have a valid Aadhaar number and a registered mobile number linked to the Aadhaar card to use the app for generating a digital life certificate.