Planning to surrender your LIC policy? Life situations often change, and sometimes continuing an insurance policy may no longer fit into your financial goals. In such cases, surrendering a LIC policy becomes the right option. The good news is that the LIC policy surrender process is simple, and you can complete it either online or offline.

This detailed guide explains how to surrender a LIC policy online, as well as the step-by-step LIC policy surrender process offline at your nearest LIC branch. We’ll also cover the documents required, timelines, and what happens to your surrender value.

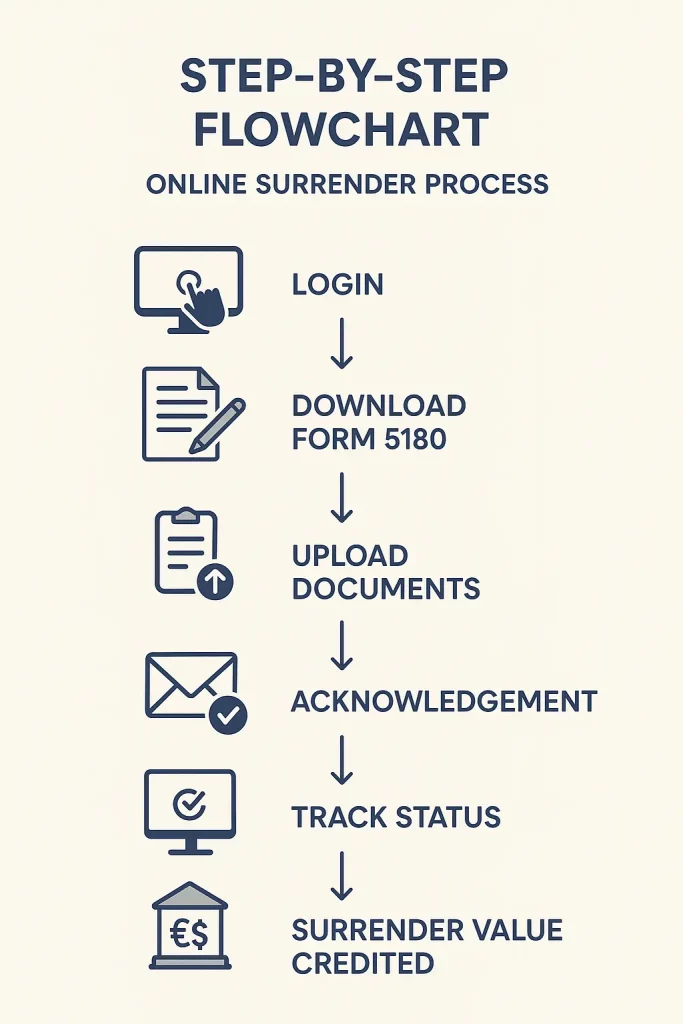

LIC Policy Surrender Online – Step-by-Step Process

For those who prefer convenience and speed, the online surrender of LIC policy is the best option. Here’s how you can do it:

1. Login to the LIC Portal

- Visit the official LIC website.

- Log in using your credentials.

- If you’re not registered, first create an account. Registration is free and takes only a few minutes.

2. Download the LIC Surrender Form

- Locate and download the Surrender Discharge Voucher (Form No. 5180).

- This is the official form required for surrendering your LIC policy. Always download it from the LIC portal to ensure authenticity.

3. Fill Out the Form Carefully

- Enter your policy details, bank information, and personal details accurately.

- Cross-check every field to avoid mistakes—errors may delay the processing of your surrender request.

4. Upload the Form and Documents

- Scan the completed form and upload it along with the required documents.

- Accepted formats usually include PDF or JPG, but check the portal for exact file size limits.

5. Acknowledgement Receipt

- Once uploaded, you’ll receive an acknowledgement confirming that LIC has received your surrender request. Keep this for your records.

6. Track Your Request Online

- Processing usually takes 1–2 weeks.

- You can track the status anytime under the “Track Service Requests” option on the LIC website.

7. Communication from LIC

- LIC may contact you via call or email for additional clarification.

- Ensure your registered mobile number and email are active.

8. Final Settlement of Surrender Value

- Once approved, your LIC surrender value will be credited directly to your registered bank account.

- With this, your policy officially ends.

Want to know more about the pros and cons of surrendering your LIC policy before maturity? Check out our detailed guide here: Surrender LIC Policy Before Maturity. It explains the impact on your returns, alternatives like making the policy paid-up, and helps you make an informed decision.

LIC Surrender Value Calculator (2025)

LIC Surrender Value Calculator (2025)

LIC Jeevan Anand

LIC Policy Surrender Offline – Traditional Method

If you prefer personal guidance and paperwork, you can also surrender your LIC policy by visiting a branch or contacting your LIC agent. Here’s how:

1. Visit LIC Branch or Contact Your Agent

- Approach your LIC agent (the one who helped you buy the policy) or directly visit the nearest LIC branch.

- Inform them that you want to surrender your policy. They will provide you with the required surrender form.

For a complete step-by-step guide on policy closure and to estimate your payout, visit our article on How to Surrender LIC Policy. This page also includes a handy LIC surrender value calculator to help you check the amount you may receive.

2. Fill Out the LIC Surrender Form

- Carefully fill in your policy details.

- Double-check your information to avoid delays.

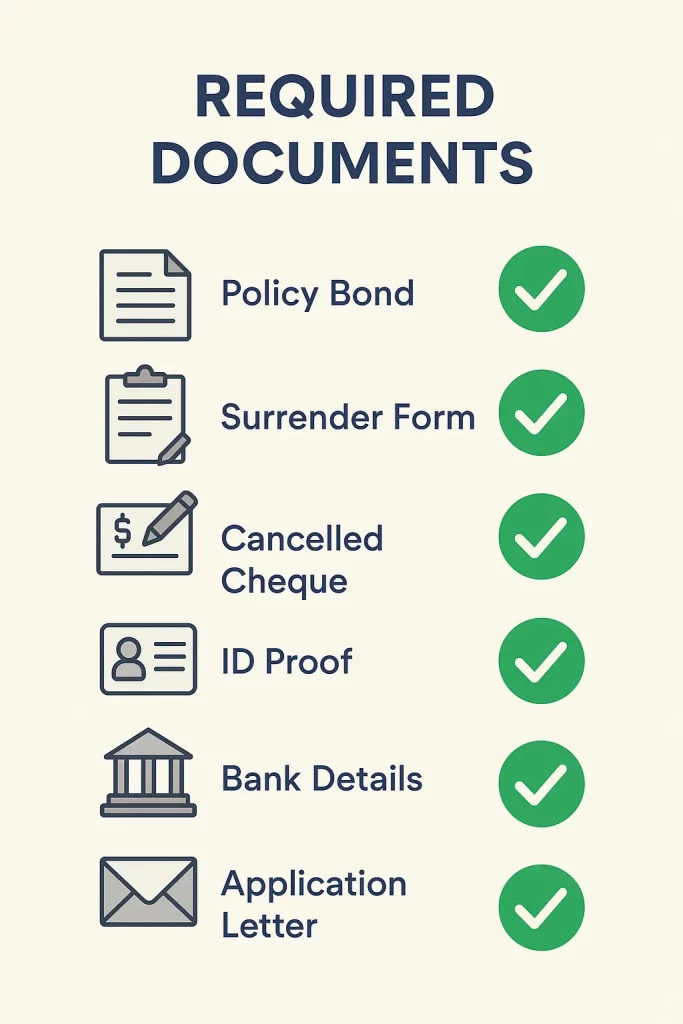

3. Collect the Required Documents

Prepare the following documents before submission:

- Duly filled LIC policy surrender form

- Original policy bond

- Cancelled cheque (for bank verification)

- Valid ID proof (original and photocopy)

- Bank account details

- A short application letter stating the reason for surrender

4. Submit at Branch or Through Agent

- Hand over the documents at the branch.

- If you’re working through an agent, they can also submit on your behalf.

- Some supporting documents may also be uploaded online for convenience.

5. Acknowledgement and Verification

- LIC will issue an acknowledgement receipt confirming your request.

- Your documents and form will be verified by LIC officials.

6. Processing Time

- The offline surrender process usually takes about two weeks.

- LIC may reach out for clarification if required.

7. Credit of Surrender Value

- Once everything is verified, your LIC policy surrender value will be credited directly to your bank account.

- Your policy then stands officially terminated.

Things to Keep in Mind Before Surrendering Your LIC Policy

- Impact on Savings: Surrendering a policy early may reduce your overall returns.

- Check Surrender Value: Confirm the surrender value on the LIC portal or with your agent before proceeding.

- Alternative Options: Sometimes converting a policy to “paid-up” status is a better choice than surrendering.

Thinking of stopping your LIC policy midway? Before you take the final call, check out this guide on Surrendering LIC Policy Before Maturity. It breaks down what really happens and what smarter options you might have.

Final Thoughts

The LIC surrender process is designed to be simple, whether you choose the online surrender option for speed or the offline surrender process for personal assistance.

- If you’re tech-savvy, surrendering your LIC policy online is quick and convenient.

- If you prefer face-to-face interactions, visiting your LIC branch or agent ensures guided support.

In both cases, once the surrender request is processed, the surrender value is deposited directly into your bank account and your policy officially comes to an end.

By following the correct steps and preparing the required documents, you can close your LIC policy with clarity and confidence.

✅ Pro Tip: If you’re in Gurgaon and looking for help with LIC policies, including surrender, loans, maturity, or claims, visit InsuringGurgaon.com or contact your local LIC agent for personalized guidance.

Can I surrender my LIC policy online?

Yes, LIC allows policyholders to surrender their policy online through the LIC portal. You need to download Form 5180, fill it out carefully, upload documents, and track the status online.

2. What documents are required to surrender a LIC policy?

The key documents required are:

- Filled surrender form (Form No. 5180)

- Original policy bond

- Cancelled cheque

- ID proof (original + photocopy)

- Bank account details

- Short application letter stating the reason for surrender

3. How long does it take to get the LIC surrender value?

On average, the LIC surrender process takes 1–2 weeks. After successful verification, the surrender value is directly credited to your registered bank account.

4. Can I surrender my LIC policy at any branch?

Yes, you can surrender your LIC policy at any LIC branch in India, not just the one where you purchased the policy.

5. What happens if I surrender my LIC policy early?

If you surrender your policy within the first 3 years, you may not receive any surrender value. After 3 years, LIC pays a reduced surrender value, which is usually lower than the maturity amount.