Life Insurance Corporation of India (LIC) is trusted by millions of Indians for financial protection. But sometimes, due to delay or non-payment of premium, your LIC policy may lapse, and you lose coverage.

The good news is – LIC gives you multiple options to revive your lapsed policy and restore all the benefits.

This page will guide you step by step on:

- ✅ How to revive your lapsed LIC policy online & offline

- ✅ Forms like 720 and 680 for revival

- ✅ Latest LIC Lapsed Policy Revival Scheme 2025 with discounts

- ✅ LIC Gurgaon helpline and branch support

- ✅ Alternatives if revival is not possible

- ✅ Revival calculators, request forms, and FAQs

What is a Lapsed LIC Policy?

A policy is considered lapsed when you don’t pay the premium even after the grace period.

- Life cover stops

- Maturity & bonuses stop

- Premiums already paid may lose full benefit

👉 Revival helps you restore all these benefits.

How to Revive a Lapsed LIC Policy?

1. Online Revival

- Visit LIC’s Customer Portal

- Login with your policy number & credentials

- Check Revival Quotation

- Pay premium + late fee online

- Track Revival Status online

How can I revive my lapsed LIC policy online, LIC revival quotation online, LIC policy revival status

2. Offline Revival (LIC Branches in Gurgaon)

- Visit nearest LIC branch in Sector 14, Sector 44, Sohna Road, or Palam Vihar

- Fill Form 720 (revival request) or Form 680 (special revival)

- Pay unpaid premium + interest

- Submit medical reports if required

- Get confirmation of revival

Revival of lapsed policy form 720, Revival form 680, LIC Gurgaon phone helpline

Revival Options in LIC

LIC offers 5 ways to revive a policy:

- Ordinary Revival – Pay all arrears with interest.

- Special Revival – Change policy start date & pay one premium.

- Installment Revival – Pay revival dues in EMIs.

- Loan-Cum-Revival – Use policy loan to pay dues.

- Survival Benefit-Cum-Revival – Adjust dues against survival benefit.

Guidelines for policy holders

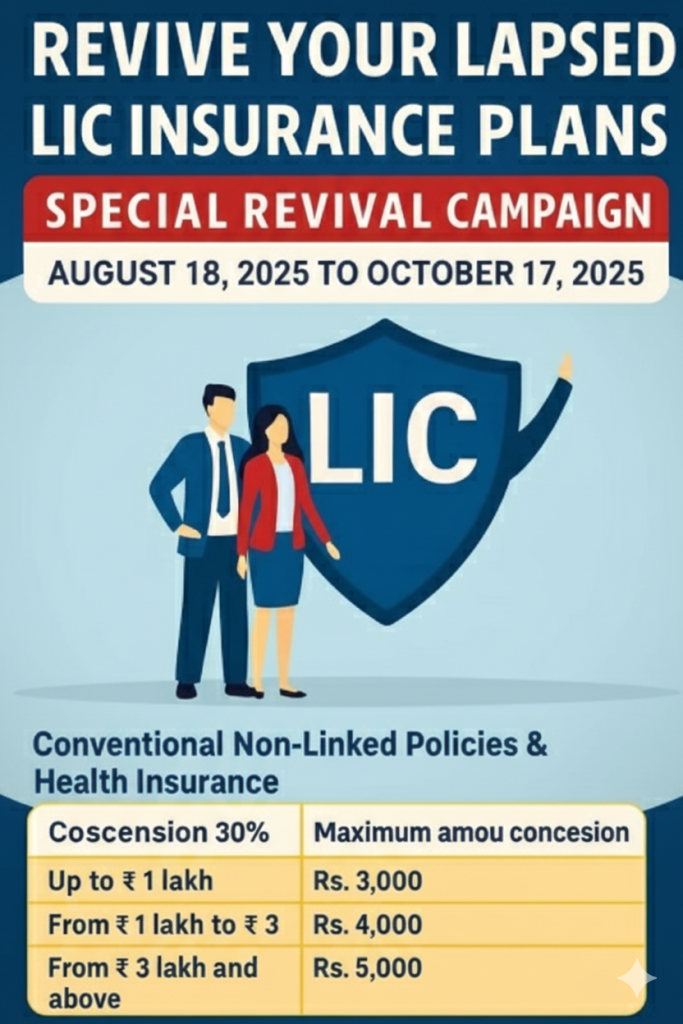

LIC Lapsed Policy Revival Scheme 2025

LIC regularly launches revival campaigns to encourage policyholders to restart their lapsed policies.

- Discount on late fees & interest (up to 30%)

- Valid for a limited period only

- Applies to select traditional & endowment policies

LIC lapsed policy revival scheme 2025

LIC Policy Revival After 5 Years

- Revival is allowed only within 5 years from first unpaid premium.

- After 5 years, policies cannot be revived.

- Alternatives available:

- Surrender policy (get surrender value)

- Convert to paid-up policy (reduced benefits)

- Buy a new policy

LIC policy revival after 5 years, Lapsed LIC policy refund

Alternatives to Revival

If you don’t want to revive:

- Surrender Value – Get partial money back. Use our Surrender Value Calculator.

- Paid-Up Policy – Keep reduced cover without paying further premiums.

- New Policy – Start fresh at current premium rates.

- LIC surrender value calculator

LIC Revival Calculator (Late Fee & Interest)

Wondering how much revival will cost?

👉 Use our Revival Calculator:

- Enter policy number, premium, lapse months

- Get pending premium + late fee instantly

[Request Personalized Revival Quote – Free]

What is the revival late fee in LIC?

LIC Gurgaon Helpline & Branches

For quick support in Gurgaon:

- 📞 Helpline: 1251 or call local branch directly

- 📍 LIC Branches: Sector 14, Sector 44, Sohna Road, Palam Vihar

LIC Gurgaon phone helpline, quick and reliable support

Required Forms & Documents

- Form 720 – General revival form

- Form 680 – Special revival cases

- Declaration of Good Health (DGH) – For longer lapsed policies

- Policy bond, ID proof, medical tests if required

[📥 Download LIC Revival Forms]

LIC revival forms, DGH

Step-by-Step Revival Process

- Check if your policy is within 5 years of lapse.

- Get revival quotation online or at branch.

- Fill revival form (720/680).

- Pay pending premiums + interest.

- Submit medical/DGH if needed.

- Track revival status online.

FAQs on LIC Policy Revival

Q1. Can I revive my LIC policy online?

➡ Yes, through LIC’s customer portal by checking quotation and paying online.

Q2. What is Revive Policy?

➡ Revival means restoring benefits of a lapsed LIC policy by paying overdue premiums.

Q3. Can I revive a lapsed policy?

➡ Yes, within 5 years of the first unpaid premium.

Q4. क्या मैं अपनी एलआईसी पॉलिसी को ऑनलाइन पुनर्जीवित कर सकता हूं?

➡ हाँ, आप LIC पोर्टल से ऑनलाइन पुनर्जीवित कर सकते हैं।

Q5. क्या मैं एक व्यपगत पॉलिसी को पुनर्जीवित कर सकता हूं?

➡ हाँ, यदि यह 5 वर्षों के भीतर है।

Q6. What is LIC revival?

➡ It is the process of restoring a lapsed LIC policy.

Q7. What is the revival late fee in LIC?

➡ Late fee is interest on unpaid premiums (usually 8–10% p.a.).

Q8. Who is benefited in policy revival?

➡ Policyholder & their family, since coverage is restored.

Q9. What is revival payment?

➡ The total of overdue premiums + late fees to reactivate policy.

Q10. How to revive reduced paid-up LIC policy?

➡ Pay pending dues + interest within 5 years.

Q11. Can I get money from a lapsed policy?

➡ Only surrender value, not full premiums.

Q12. Can you reactivate a lapsed policy?

➡ Yes, within 5 years.

Q13. Can we surrender a lapsed LIC policy?

➡ Yes, if it has acquired surrender value.

Q14. एलआईसी में डीजीएच के साथ पुनरुद्धार क्या है?

➡ लंबे समय से व्यपगत पॉलिसी के लिए स्वास्थ्य प्रमाणपत्र देना ज़रूरी है।

Q15. एलआईसी में कितना सरेंडर वैल्यू कैलकुलेट किया जाता है?

➡ यह आपके प्रीमियम भुगतान और बोनस पर आधारित होता है।

Q16. क्या मैं अपनी एलआईसी पॉलिसी को ऑनलाइन नवीनीकृत कर सकता हूं?

➡ हाँ, LIC पोर्टल पर लॉगिन कर सकते हैं।

Q17. पुनरुद्धार अवधि क्या है?

➡ अधिकतम 5 साल।

Q18. क्या मैं व्यपगत बीमा पॉलिसी को पुनः आरंभ कर सकता हूं?

➡ हाँ, लेकिन LIC की शर्तों के अनुसार।

Why Choose InsuringGurgaon.com?

We help Gurgaon customers with:

- ✅ Free revival fee calculation

- ✅ Filling forms 720/680

- ✅ Assistance in LIC revival scheme 2025

- ✅ Quick LIC branch support in Gurgaon

👉 Don’t lose your LIC benefits – revive today.