Nivesh Plus is a non-participating, unit-linked, individual life insurance savings plan offered by Life Insurance Corporation of India (LIC). The plan aims to provide market-linked returns while also providing life cover to the policyholder.

LIC Nivesh Plus – Key Plan Details

| Feature | Details |

|---|---|

| Plan Number & UIN | Plan No. 849 |

| Launch Date | March 2, 2020 (discontinued Oct 14, 2024) — the original Nivesh Plus ULIP product was launched on this date. |

| Entry Age Limits | From 90 days (completed) Maximum entry age differs by Sum Assured option: – Option 1: up to 70 years nearer birthday – Option 2: up to 35 years nearer birthday |

| Maturity Age | Minimum: 18 years (completed) Maximum: 85 years (for Option 1) or 50 years (for Option 2) |

| Minimum Basic Sum Assured | Single premium of ₹1,00,000; minimum Sum Assured = options: |

- ** Option 1:** 1.25 × single premium

- ** Option 2:** 10 × single premium

Maximum sum assured: No upper limit, subject to underwriting

| Sum Assured on Death | If life assured dies before commencement of risk → unit fund value payable. If death occurs after risk commencement → nominee receives the higher of: - Basic Sum Assured (reduced by partial withdrawals in last 2 years)

- Unit Fund Value

Summary

LIC’s Nivesh Plus is a single premium ULIP launched in March 2020 (Plan 849, UIN 512L317V01). Eligibility starts from 90 days old; maximum entry age depends on the Sum Assured option. Sum Assured options include either 1.25× or 10× of the lump sum premium, with no upper limit. On death, claims are paid either as the fund value or the higher Sum Assured, whichever is greater — provided the policy is in force. This information is sourced from LIC’s official brochure and verified agent-level criteria

Here is a table that shows the premium rates for Nivesh Plus policy for a premium payment term of 10 years:

| Age (in years) | Policy Term (in years) | Premium (in Rs.) |

|---|---|---|

| 30 | 10 | 40,000 |

| 35 | 10 | 50,000 |

| 40 | 10 | 70,000 |

| 45 | 10 | 1,00,000 |

Please note that these are indicative premium rates, and the actual premium rates may vary based on age, premium payment term, policy term, sum assured, and other factors. It is always advisable to check with the LIC agent or visit the LIC website for the latest premium rates.

| Nivesh Plus – Sum Assured options | |

| Option 1 | 1.25 times of the Single Premium |

| Option 2 | 10 times of the Single Premium |

| Option once selected cannot be altered | |

Nivesh Plus (Plan 849) -Investment funds available

| Fund Type | Investment in Government/Government Guaranteed Securities/Corporate Debt | Short -term Investments such as money market instruments | Investment in listed equity shares | Objective | Risk Profile |

| Bond Fund | Not less than 60% | Not more than 40% | Nil | To provide relatively safe and less volatile investment option mainly through accumulation of income through investment in fixed income securities | Low risk |

| Secured Fund | Not less than 45% and not more than 85% | Not more than 40% | Not less than 15% and not more than 55% | To provide steady income through investment in both equities and fixed income securities | Lower to medium risk |

| Balanced Fund | Not less than 30% and not more than 70% | Not more than 40% | Not less than 30% and not more than 70% | To provide balanced income and growth through similar proportion investment in both equities and fixed income securities | Medium risk |

| Growth Fund | Not less than 20% and not more than 60% | Not more than 40% | Not less than 40% and not more than 80% | To provide long term capital growth through investment primarily in equities | High Risk |

Guaranteed Additions – Adding value to the plan

Guaranteed Additions in LIC Nivesh Plus are a key feature that rewards policyholders over time. These additions are calculated as a percentage of the annualized premium (excluding taxes and extra charges) and are added to the Unit Fund value at specific milestones during the policy term. They are not added every year but only at the end of certain policy years, as specified in LIC’s product brochure. Importantly, these Guaranteed Additions are credited only if the policy is in force—meaning all due premiums have been paid and the policy has not lapsed.

Nivesh plus – Policy term restrictions

| Option 1: If Basic Sum Assured is 1.25 times of Single Premium | Option 2: If Basic Sum Assured is 10 times of Single Premium | ||

| For age at Entry up to 25 Years | For Age at entry 26 to 30 Years | For age at entry 31 to 35 years | |

| 10 to 25 years | 10 to 25 Years | 10 to 20 Year | 10 Years |

The purpose of Guaranteed Additions is to enhance the long-term value of your investment by providing an assured boost to the fund value, independent of market performance. These additions act as loyalty rewards and offer a cushion against short-term market volatility. For example, if the policy promises 5% of one annualized premium as a guaranteed addition after 5 years, this amount is directly added to your fund’s NAV, thereby increasing your corpus. This feature makes Nivesh Plus attractive for those looking for both insurance protection and disciplined long-term investing.

| End of policy year | Guaranteed additions (% of annualized premium) |

| 6 | 3% |

| 10 | 4% |

| 15 | 5% |

| 20 | 6% |

| 25 | 7% |

Mortality Charges

The mortality charge in LIC Nivesh Plus is the cost for providing life insurance coverage and is deducted at the start of each policy month by canceling a certain number of units from your fund. This charge varies based on the “sum at risk,” which is calculated as the difference between the basic sum assured and the current unit fund value on the date the charge is applied. Essentially, the higher the protection gap between your sum assured and your investment value, the higher the mortality charge will be.

| Example of Mortality Charges | |||

| Age | Charge | Age | Charge |

| 10 | 0.55 | 50 | 6.18 |

| 20 | 1.11 | 60 | 14.42 |

| 30 | 1.32 | 70 | 32.32 |

| 40 | 2.25 | 80 | 75.70 |

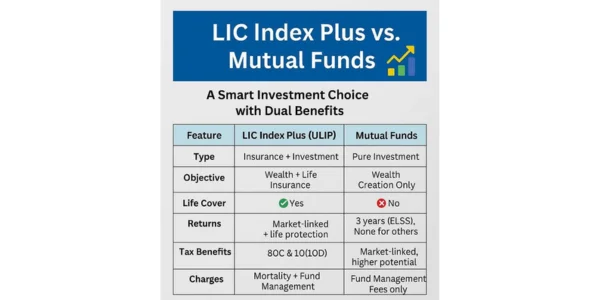

Fund management charges

| Fund Management Charge | |

| Fund | Charge applicable |

| Bond Fund, Secured Fund, Balanced Fund, Growth Fund | 1.35% of unit fund per year |

| Discontinued Policy Fund | 0.50% of unit fund per year |

Fund management charges are fees deducted for managing the investment funds under your policy. These charges are applied as a percentage of the total value of the assets and are factored in during the daily calculation of the Net Asset Value (NAV). This means the NAV you see is already adjusted for fund management costs, ensuring transparent reflection of your investment’s actual value.

Discontinuance charges

This charge is applied when the policy is discontinued and is recovered by canceling a certain number of units from the unit fund value on that specific date. It helps cover administrative and other expenses incurred due to the premature termination of the policy.

| Year of discontinuation | Single premium(SP) up to Rs.3,00,000 | Single premium (SP) above Rs.3,00,000 |

| 1 | Lower of 2% of SP or FV subject to a maximum of Rs.3,000 | Lower of 1% of SP or FV subject to a maximum of Rs.6,000 |

| 2 | Lower of 1.5% of SP or FV subject to a maximum of Rs.2,000 | Lower of 0.7% of SP or FV subject to a maximum of Rs.5,000 |

| 3 | Lower of 1.00% of SP or FV subject to a maximum of Rs.1,500 | Lower of 0.5% of SP or FV subject to a maximum of Rs.4,000 |

| 4 | Lower of 0.5% of SP or FV subject to a maximum of Rs.1,000 | Lower of 0.35% of SP or FV subject to a maximum of Rs.2,000 |

| 5 and on wards | Nil | Nil |