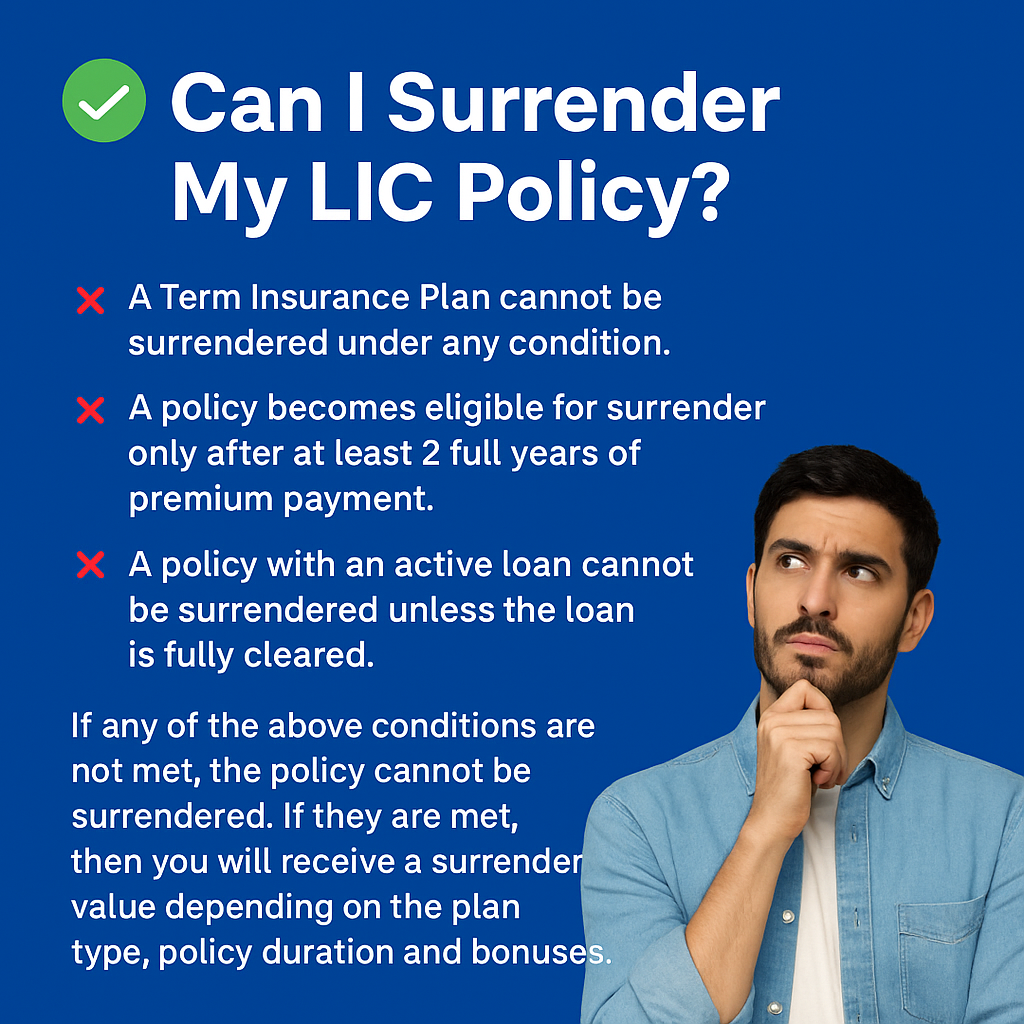

Before surrendering any LIC policy, you must understand three fixed rules laid down by LIC:

1️⃣ A Term Insurance Plan cannot be surrendered under any condition.

2️⃣ A policy becomes eligible for surrender only after at least 2 full years of premium payment.

3️⃣ A policy with an active loan cannot be surrendered unless the loan is fully cleared.

If any of the above conditions are not met, the policy cannot be surrendered. If they are met, then you will receive a surrender value depending on the plan type, policy duration and bonuses.

Still Confused About Your Policy?

Many people are unsure about their policy type, loan status, or total premium years — so this simple online checker (the form below) helps you instantly know whether your LIC policy is eligible for surrender.

Can I Surrender My LIC Policy?

What Happens After You Check Eligibility?

Once you complete the form, I will personally check your LIC policy details and confirm:

✔ Whether your policy is eligible for surrender

✔ Whether surrendering is the best financial decision

✔ Whether revival, paid-up, or loan is a better option

✔ Exact surrender value estimate (if applicable)

This ensures you don’t lose money or take the wrong step due to confusion.

Things to Know Before Surrendering an LIC Policy

Here are some important points everyone should consider:

1. Surrender Value Is Always Lower Than Maturity

When you surrender, you only get the guaranteed surrender value + applicable bonus. This is always less than the policy’s maturity amount.

2. Surrendering Early Gives the Lowest Return

If you surrender right after 2 years of premium, you may get very little. The value increases only after several years.

3. Loan or Paid-Up Options May Be Better Than Surrender

Instead of surrendering, you may convert the policy into paid-up or take a loan — this often gives better long-term benefits.

4. Tax Benefits May Reverse

Surrendering early could result in tax implications if Section 80C deductions were claimed — something most people overlook.

FAQs – LIC Policy Surrender

1. How long does LIC take to pay surrender value?

Usually 3–10 working days after you submit all documents at the LIC branch.

2. Which documents are required for surrender?

Original policy bond, bank details, KYC, cancelled cheque, and surrender request form.

3. Can I surrender a policy online?

As of now, full surrender usually requires a visit to the LIC branch, but value estimation and eligibility checking can be done online.

4. What if I don’t know whether my policy has a loan?

I can check it for you. Just fill the form above — I will verify loan status from LIC records.

5. Will LIC agent commission be recovered during surrender?

No. There is no penalty related to agent commission. Surrender value is based on LIC’s fixed rules, not on the agent.