GST on LIC Premium – What You Must Know Before Paying

- Term Insurance Plans: 18% GST on premium

- Endowment (Savings) Plans:

- First year premium: 4.5% GST

- Renewal premiums: 2.25% GST

- ULIPs (Unit Linked Insurance Plans):

- GST applies only on charges, not on total premium

- Fund management & mortality charges: 18% GST

- Pension Plans (Immediate/Deferred Annuity):

- Single premium: 1.8% GST

- Annuity payouts: No GST applicable

Are you surprised to see extra charges added to your LIC premium amount? That’s the GST (Goods and Services Tax)—a government-imposed tax that applies to almost all life insurance products in India. Whether you’re buying a term plan, an endowment plan, or investing in a ULIP, understanding how GST works on LIC premiums can help you plan your finances better.

Let’s break it down in simple terms.

What Is GST on LIC Premium?

The Goods and Services Tax (GST) is a unified indirect tax that applies to various goods and services—including life insurance. When you pay your LIC premium, a percentage of it goes towards GST based on the type of policy you hold.

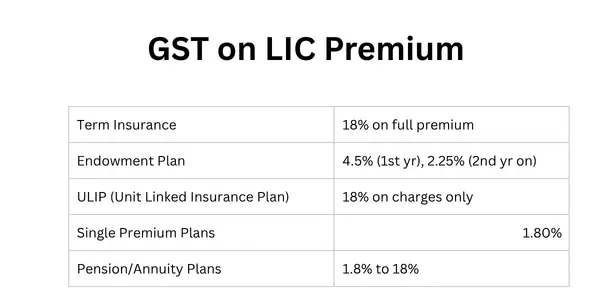

GST Rates for Different LIC Policies

Here’s a simple table showing how much GST you’ll be charged depending on your policy:

| LIC Policy Type | GST Rate | Applicability |

|---|---|---|

| Term Insurance | 18% on full premium | Pure risk cover |

| Endowment Plan | 4.5% (1st yr) 2.25% (2nd yr onward) | Savings + insurance |

| ULIP (Unit Linked Insurance Plan) | 18% on charges only | Charges like fund mgmt, allocation, etc. |

| Single Premium Plans | 1.8% | One-time payment |

| Pension/Annuity Plans | 1.8% to 18% | Based on type & payout |

Practical Example

Let’s say you buy a Term Plan with an annual premium of ₹10,000:

- Base Premium: ₹10,000

- GST @18%: ₹1,800

- Total Payable: ₹11,800

If you buy an Endowment Plan with the same premium:

- First Year GST @4.5%: ₹450

- 2nd Year Onward GST @2.25%: ₹225

So the type of policy you choose directly impacts your total cost over time.

Why Does the Government Charge GST on LIC Policies?

Because insurance is classified under financial services, it attracts GST. Whether it’s term insurance, money-back policies, or investment-linked plans like ULIPs, GST applies as per tax slabs set by the government.

The GST you pay goes to the government and is not a commission or extra charge by LIC or your LIC agent.

Are There Any GST Exemptions or Deductions?

- Input Tax Credit (ITC): Available only if the policy is bought for business purposes, not for individual use.

- No separate tax benefit for GST paid, but the total premium including GST qualifies for Section 80C deduction in income tax, up to ₹1.5 lakh annually.

Can You See GST Breakup in Your Policy?

Yes, every premium receipt issued by LIC shows a clear breakdown of:

- Base Premium

- GST Amount

- Total Paid

You can also view it on the MyLIC app or official LIC website under the “Premium Paid Statement.”

Final Thoughts

While GST adds a little extra to your premium amount, it’s a standard charge applicable to all insurance providers—not just LIC. Knowing your GST liability helps you make more informed decisions about your life insurance planning.

Need help choosing the right LIC policy and understanding total cost including GST?

I’m a registered LIC Agent in Gurgaon with over 10 years of experience. Whether you’re looking for a tax-saving plan, a term policy, or long-term pension—I’ll guide you at every step.

Let’s talk!

Call/WhatsApp: +91-9891420503

Visit: www.insuringgurgaon.com