On November 29, 2023, LIC introduced a new insurance plan called Jeevan Utsav LIC Plan, designed for all segments of society. This plan has become highly popular since its launch because most LIC plans typically have a 20-year term, securing the customer’s entire life. However, acknowledging that not everyone prefers such long durations, LIC has significantly reduced the term for this plan to just 5 to 16 years. This change has excited people as it means they no longer have to wait for extended periods.

1. Introduction

LIC Jeevan Utsav (Plan No. 871, UIN: 512N362V01) is a whole life, non-linked, non-participating savings cum protection plan. Launched in November 2023, it offers guaranteed lifelong income after a limited premium paying term of 5 to 16 years. With flexible payout options, this plan is ideal for those seeking guaranteed, tax-free income for life.

2. Eligibility & Key Terms

- Entry Age: 90 days (completed) to 65 years

- Policy Term: Whole life (till 100 years of age)

- Premium Paying Term (PPT): 5 to 16 years

- Minimum Basic Sum Assured: Rs. 5,00,000

- Maximum Sum Assured: No upper limit (subject to underwriting)

- Premium Payment Modes: Yearly, Half-yearly, Quarterly, Monthly (NACH or Salary Deduction)

- Grace Period: 30 days (Yearly/Half-Yearly/Quarterly), 15 days (Monthly)

3. Guaranteed Additions

- Accrue during the Premium Paying Term

- Rate: Rs. 40 per Rs. 1,000 Basic Sum Assured per year

- Example: For Rs. 10 lakh SA, yearly GA = Rs. 40,000 during PPT

4. Income Options

Regular Income Option

- Fixed annual income of 10% of Basic Sum Assured

- Starts one year after completion of PPT

- Continues till death or 100 years of age

Flexi Income Option

- Defer annual income and let it accumulate with 5.5% compound interest p.a.

- Withdraw accumulated income any time as lump sum or partially

- Withdrawals allowed up to 75% of accumulated income without medicals

Income Start Chart (Indicative)

| Premium Paying Term | Income Start Year |

|---|---|

| 5 to 8 years | 11th policy year |

| 9 to 16 years | 13th policy year |

5. Death Benefit

In case of death during the policy term:

- Sum Assured on Death + Guaranteed Additions

- Sum Assured on Death = higher of:

- 7 times the Annualized Premium, OR

- Basic Sum Assured

- Death Benefit shall not be less than 105% of total premiums paid

- Paid either as lump sum or in instalments (as per nominee’s choice)

6. Loan, Surrender & Revival

- Loan: Available after 2 full years’ premium payment

- Surrender: Allowed after 2 years; surrender value includes guaranteed additions

- Revival: Within 5 years from the date of first unpaid premium

- Free-Look Period: 30 days (for online); 15 days (for offline policies)

7. Riders (Optional Benefits)

Up to 4 riders can be added for extra protection:

- LIC’s Accidental Death & Disability Benefit Rider

- LIC’s Accident Benefit Rider

- LIC’s New Term Assurance Rider

- LIC’s Critical Illness Benefit Rider

- LIC’s Premium Waiver Benefit Rider

8. Tax Benefits

- Section 80C: Tax deduction on premium paid (up to Rs. 1.5 lakh/year)

- Section 10(10D): Tax-free income and death benefit, subject to policy conditions

9. Advantages & Considerations

Advantages:

- Guaranteed lifelong income

- Flexibility between fixed and deferred income

- Tax-free payouts

- Loan facility available

- Riders for enhanced protection

Considerations:

- No maturity benefit

- Income begins after deferment period (not immediate)

- No market-linked returns

10. Illustrative Table

Particulars | Regular Income Option | Flexi Income Option |

| Basic Sum Assured | Rs. 10,00,000 | Rs. 10,00,000 |

| Annual Income | Rs. 1,00,000 | Accumulates with 5.5% p.a. |

| Payout Start | Year 11 or 13 | Any time after deferment |

| Withdrawal Flexibility | No | Yes – Partial or Full |

| Accumulated Interest | Not applicable | 5.5% compound annually |

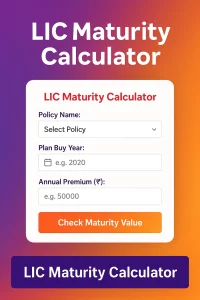

Calculate LIC Jeevan Utsav Maturity

11. Frequently Asked Questions (FAQs)

Q1: Can I withdraw money before income starts? No, income starts only after the deferment period. Flexi option allows deferred withdrawal.

Q2: Is there a maturity benefit in this plan? No. LIC Jeevan Utsav does not offer a maturity benefit. It offers lifelong income instead.

Q3: Can I take a loan on this policy? Yes, after payment of 2 full years’ premiums, loans are available.

Q4: What happens if I miss a premium? Grace period applies. If policy lapses, it can be revived within 5 years.

Q5: Is the income from this policy taxable? No, under Section 10(10D), the income is tax-free, subject to conditions.

Q6: How many riders can I choose? You can choose up to 4 out of the 5 available riders.

Q7: What’s the best option for young buyers? Flexi Income Option gives more control and potential accumulation for long-term needs.

12. Resources & Downloads

- Download LIC Jeevan Utsav Brochure (PDF)

- Official LIC Jeevan Utsav Page

- For calculators, quotes, or personalized advice, visit: www.insuringgurgaon.com

Buy Jeevan Utsav Online in Gurgaon

The Life Insurance Corporation (LIC) of India is the only insurance company in India that consistently offers excellent Life Insurance plans for its customers. If your child is under 5 years old, you should definitely consider this plan, as it will provide significant benefits by the time they reach 18 to 21 years of age, ensuring their future and resolving any financial issues related to education.

Now, you only need to invest for 5 years and start receiving guaranteed returns from the 11th year onward.

Jeevan Utsav LIC Plan Premium Calculator for 5 Years

This plan is not linked to the market. To understand what the market is, it refers to when a company invests your money in stock market schemes, where you bear the risks of profit and loss. This plan does not operate that way, meaning you will receive the guaranteed returns promised initially.

You are required to pay premiums for a minimum of 5 years and a maximum of 16 years. For the 5-year term, there is a 5-year waiting period. For other terms, the waiting period is 3 years. Jeevan Utsav is a superb plan from LIC, offering an 8% guaranteed return. However, this plan provides a 10% income, which is quite beneficial.

Who Can Avail Jeevan Utsav LIC Plan?

- Fathers can definitely take this plan for their children.

- Husbands and wives can also opt for this plan to avoid future financial difficulties.

If a father takes this policy, their child will not face a shortage of ₹50,000 throughout their life. One of the most significant advantages of this plan is that it provides lifelong financial security.